This means employers and independent contractors are legally allowed to deduct that amount from their taxes when reimbursing employees for mileage accrued while driving for company purposes.

If your home office is less than 300 square feet, there's a simplified option that lets you write off $5 per square foot. The current IRS mileage deduction rate as of July 2022 is 0.625 per mile. Paperwork: The standard way to deduct your home office expenses is by filling out IRS Form 8829, which involves calculating the percentage of square footage the workspace takes up relative to the entire home. It helps to have a floorplan of your workspace handy with the exact measurements of your home office in case you get audited. If your home office takes up 15% of your home, you can also deduct 15% of your annual utilities, like electricity. That means that while you can claim costs from an entire room you dedicate to your work, you may have a harder time deducting office space in the same room as your bedroom or living room. Keep in mind that according to the IRS, you can only take a home office deduction for parts of your house that are used both "regularly and exclusively," for your business. That percentage is equal to the percentage of you home’s square footage used for work. If the contractors agreement with the employer states that the employer will reimburse for mileage, that could give the contractor an ability to collect pay. If you rent (rather than own) your home office space and quality for the home office deduction, you can deduct a percentage of your monthly rent. Additionally, while business insurance may be. When a contractor is travelling to a project in their own vehicle, a travel and expenses policy will usually state that mileage will be reimbursed at a specified business mileage rate, e.g.

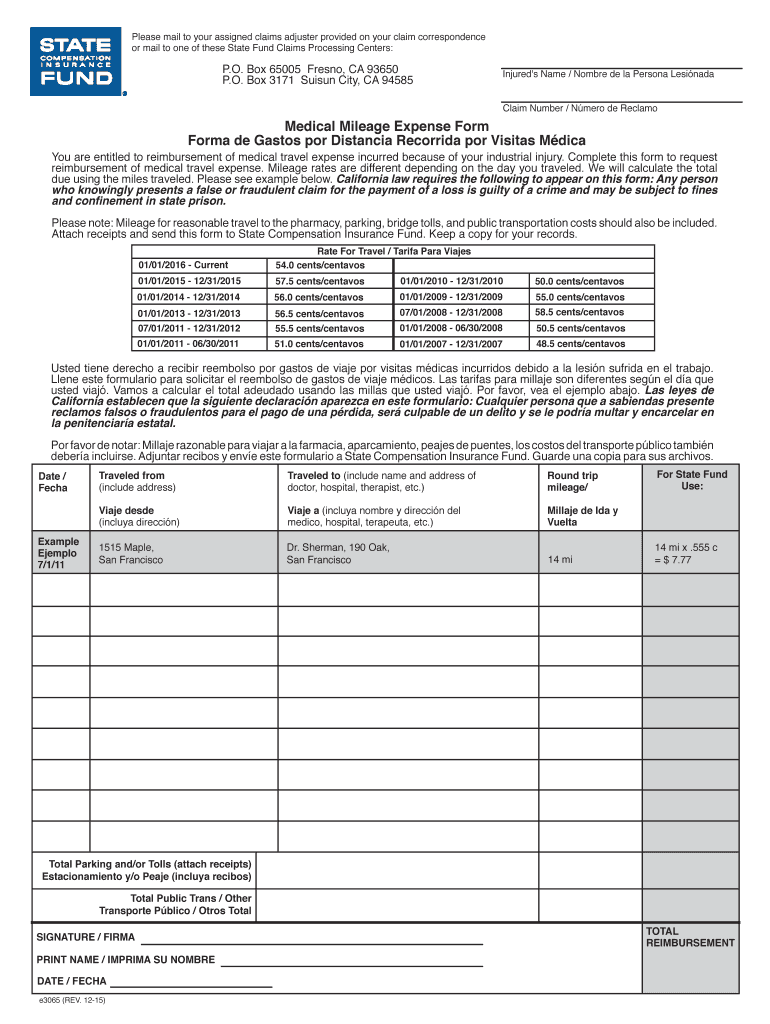

If you work from home, you can deduct a portion of your housing costs from your taxes. The mileage reimbursement rate, which changes annually, is currently 57 cents per mile.

0 kommentar(er)

0 kommentar(er)